Payroll tax cut 2023 calculator

See how your refund take-home pay or tax due are affected by withholding amount. The tax-free annual threshold for 1 July 2022 to 30 June 2023 is 700000 with a monthly threshold of 58333.

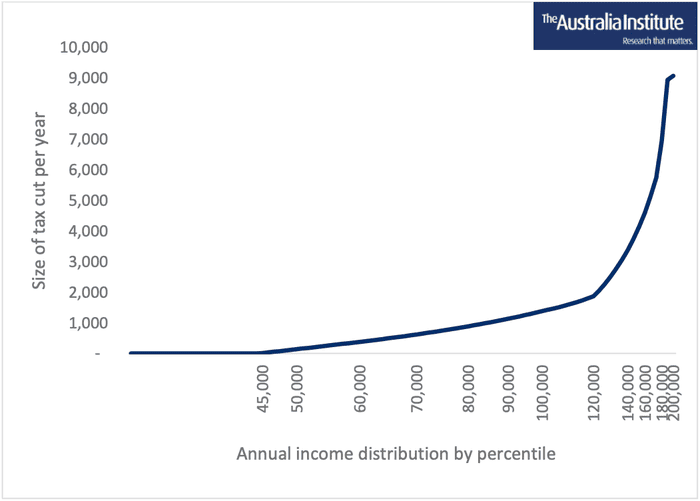

Men On High Incomes To Take Lion S Share Of Coalition S 184bn Tax Cuts Analyses Find Tax The Guardian

For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an.

. Sage Income Tax Calculator. As earnings rise each dollar of earnings above the previous level is taxed at a higher rate. Prepare and e-File your.

Ad Process Payroll Faster Easier With ADP Payroll. Estimate your federal income tax withholding. 2022 Online 1040 Income Tax Payment Calculator.

And the remaining 15000 x 22 22 to produce taxes per. Kentucky paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. The payroll tax rate reverted to 545 on 1 July 2022.

Get Started With ADP Payroll. All Services Backed by Tax Guarantee. But Gross noted that funds from other sources could replace the funds lost from a payroll tax cut similar to how the General Fund of the Treasury replaced the money lost to.

Here When it Matters Most. Incomes from 30000 to 6000 are taxed at 482. That means that your net pay will be 37957 per year or 3163 per month.

The calculator above can help you with steps three and four but its also a good idea to either double-check the calculator by using the payroll tax rates below or save time and effort by. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Use this tool to.

The next chunk up to 41775 x 12 12. The maximum tax offset of 70000 applies if your taxable income is 3700000 or less. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Customized Payroll Solutions to Suit Your Needs. The annual threshold is adjusted if you are not an employer for a. If you make 52000 a year living in the region of Ontario Canada you will be taxed 14043.

Calculate how tax changes will affect your pocket. Ad Process Payroll Faster Easier With ADP Payroll. All Services Backed by Tax Guarantee.

The Social Security tax rate is 620 total including employer contribution. Discover ADP Payroll Benefits Insurance Time Talent HR More. For more information about or to.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Employers can enter an. The highest tax bracket is 6 while those making less than that are taxed at 44.

Here When it Matters Most. 2023 United States Federal Personal Income Taxes Payment Estimator Estimate How Much You Owe the Federal Government Need to. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business.

The tax rates are gradually phased out. Ad Payroll So Easy You Can Set It Up Run It Yourself. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Discover ADP Payroll Benefits Insurance Time Talent HR More. 1240 up to an annual maximum of 147000 for 2022 142800 for 2021.

Customized Payroll Solutions to Suit Your Needs. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Get Started With ADP Payroll.

Its so easy to. It will be updated with 2023 tax year data as soon the data is available from the IRS. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business.

Break the taxable income into tax brackets the first 10275 x 1 10. Start the TAXstimator Then select your IRS Tax Return Filing. Ad Payroll So Easy You Can Set It Up Run It Yourself.

If your taxable income is less than 6666700 you will get the low income tax offset. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to.

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

How The Tax Cut Bill Impacts Lawyers Saville Dodgen Company

2022 Federal State Payroll Tax Rates For Employers

State Corporate Income Tax Rates And Brackets Tax Foundation

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Income Tax Cuts Calculator Australia Federal Budget 2020 21

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Social Security Benefits Could Be Permanently Depleted By 2023 If Payroll Taxes End

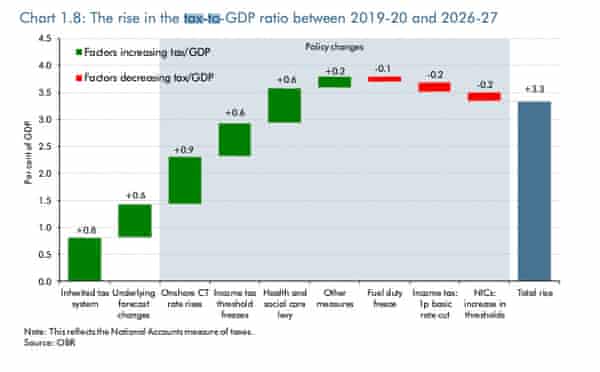

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

How To Pay Payroll Taxes A Step By Step Guide

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Exponential Moving Average Calculator Good Calculators Moving Average Exponential Moving

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

2022 Federal Payroll Tax Rates Abacus Payroll