20+ millennial mortgage

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Compare Mortgage Lenders And Find Out Which One Suits You Best.

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

Apply Online To Enjoy A Service.

. Ad See If Youre Eligible for a 0 Down Payment. Web Millennials are waiting longer than ever to buy homes. Comparisons Trusted by 55000000.

Ad Compare Best Mortgage Lenders 2023. Web The 2022 NAR survey found that millennials represent 43 of homebuyers and a quarter of this group are older millennials ages 32 to 41. Ad When Banks Say No We Say Yes.

Homeowner and has the second-highest mortgage debt load coming in just. Apply Online Get Pre-Approved Today. Compare Offers Side by Side with LendingTree.

At the start of 2021 millennials have more in savings than previous years. Answer Simple Questions See Personalized Results with our VA Loan Calculator. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

PMI is often required by a. According to the CoreLogic Loan Application Database. Only 34 of millennials did the same in 2022 when they faced stiff competition.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. 697 Homeowners Association HOA fee. Ad Compare More Than Just Rates.

Ad 5 Best Home Loan Lenders Compared Reviewed. Web Almost two-thirds of millennials 62 plan to put down less than 20 on a home. The demographic of adults born.

Web Millennials share of home purchases grew an average of 2 to 4 per year between 2014 and 2019 rising from 33 to 47. Lifes Better With Cake. Web Cake Mortgage 739 followers on LinkedIn.

Web More than half of millennials with a mortgage are paying for private mortgage insurance while another 6 opted not to say. Ad Explore Quotes from Top Lenders All in One Place. Begin Your Loan Search Right Here.

Web Millennials have made up the largest share of home purchase mortgage applications for the last six years. 180 An HOA fee is a set amount paid monthly by owners of certain types of residential. Highest Satisfaction for Mortgage Origination.

Calculate Your Monthly Loan Payment. Web 699 of the millennial borrowers who intended to buy their first home in 4 9 years said they believe they could buy in 1 3 years with student loan forgiveness. Comparisons Trusted by 55000000.

Refinance Whether youre looking to take. Web Millennials Have More Savings in 2021 but Still Struggle to Afford Down Payments. Web If you bought a home at that price and put 20 down in late 2020 when the average 30-year mortgage rate bottomed out at about 27 your monthly mortgage payment.

Find A Lender That Offers Great Service. Web Apply Now Mortgage Calculator What We Offer Home Loans Whether its FHA USDA VA etc well find the right solution to fit your needs. After the financial crisis mortgage ownership rates have declined substantially by all racesethnicity1.

Web The 2020 millennial homeownership rate stood at 48 percent according to the most recent data from the Census Bureau. Web But its fair to say that millennials are likely to make up the bulk of first-time home buyers. Get the Right Housing Loan for Your Needs.

Web The average millennial owes 11 more on their mortgage than the average US. Web Millennials are increasingly putting down roots whether that is through buying a home getting involved in their community or working with a local financial. Web So far this year Silicon Valley leads the way by that measure with millennials accounting for 64 of home mortgage applications in San Jose California.

The fastest-growing populations of potential homebuyers the millennial See more. Save Real Money Today. As of 2021 the average millennial with a mortgage owed 255527 in.

Compare Mortgage Lenders And Find Out Which One Suits You Best. Homeownership is critical for building long-term wealth and most first time homebuyers rely on obtaining a mortgage to become homeowners. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web The mortgage market may be struggling but originators can count on a steady stream of millennial demand for homes. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. For people aged 40 to 55 in 2020 Gen.

Web She puts 1375 a month toward the 3600 mortgage for the four-bedroom house she owns with her husband who also pays 1375 a roommate contributes the. Homes are 39 more expensive than they were nearly 40 years ago according to Student Loan Hero. In 2020 that share grew to 54.

Ad Use Our Comparison Site Find Out Which Hpuse Loan Suits You The Best.

Mortgage Payoff Calculator Your New Debt Free Secret Weapon March 2023 Millennial Homeowner

Events New World Mortgage

63 Homebuyers Are Millennials Ltv Key To Deciding Lender Survey

Gmn4 4nv9negqm

5 Ways To Get A Mortgage Even If You Don T Meet Income Requirements Gobankingrates

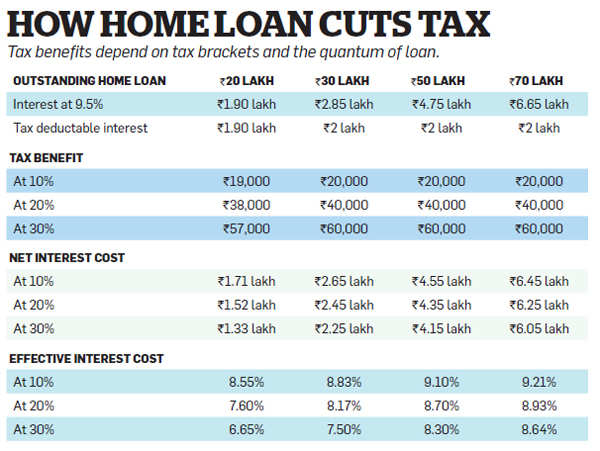

Should You Invest Your Money Or Use It To Prepay Home Loan The Economic Times

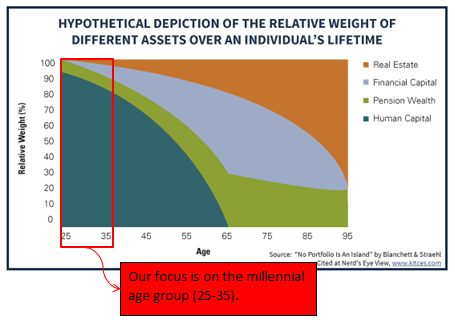

Typical Millennials Should Allocate At Least 25 Of Their Portfolio To This Specific Asset Class Seeking Alpha

Millennial Home Buyers Seen Relying On Parents For Financial Help Builder Magazine

Millennials Mortgages And Home Buying

St Bourke From The Ground Up Atlanta 1q2022 Housing Market Analysis

Millennial Homebuyers Reshape The Real Estate Market Bankrate

Study Finds 89 Percent Of Millennials Want To Own A Home But 67 Percent Will Have To Wait 20 Years Or More To Afford It Inc Com

Millennials Avoid Debt And Seek Deals

Ontario Millennials To Save For 20 Years For Down Payment Report Ctv News

Sales Of New Houses Collapse In The West By 50 Inventories Supply Spike To High Heaven Worst Since Peak Of Housing Bust 1 Wolf Street

Can Gen Z Ers Become One Of The Wealthiest Generations

Mortgages Average Millennial Owes 10 More Than They Did 2 Years Ago